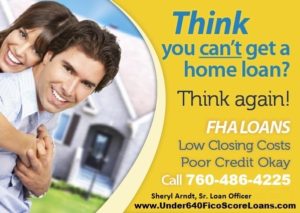

FHA Loans Give Home buyers More Options!

The FHA mortgage can make your homebuying dream a reality with competitive rates and a low down payment.

The FHA Loan Offers

- Minimum 500 fico score qualifies for 10% down

Think-you-cant-get-a-home-loan-Think-again-FHA-Loans-Under-640-Fico-Score-Loans - Minimum 580 fico score qualifies for 3.5% down

- No Pre-payment Penalty

- Assumable

- Lower interest rates than conventional loans

- Very low down payment which can be a gift

- Payment includes taxes and insurance

- Accommodates lower credit scores

- Available for SFR, condo, duplex, 3-4 units, manufactured

- Seller can pay 6% closing costs, prepaids

- No Fico Score with alternative credit Ok

- BK 2 yrs Ok

- Foreclosure, short sale, deed in lieu 3 yrs Ok

- Easier guidelines to qualify

- Up to $453,100 and High Balance/Jumbo $679,650

- 203k, 203k streamline rehab loans are available too CA only

DOCUMENTATION NEEDS LIST FHA Loan Limits

Purchase Application